Certified Management Accountant (CMA)

Earn the prestigious CMA certification and strengthen your expertise in strategic financial analysis, data-driven decision-making, and performance management.

Prepare for Success with a Trusted Global Leader

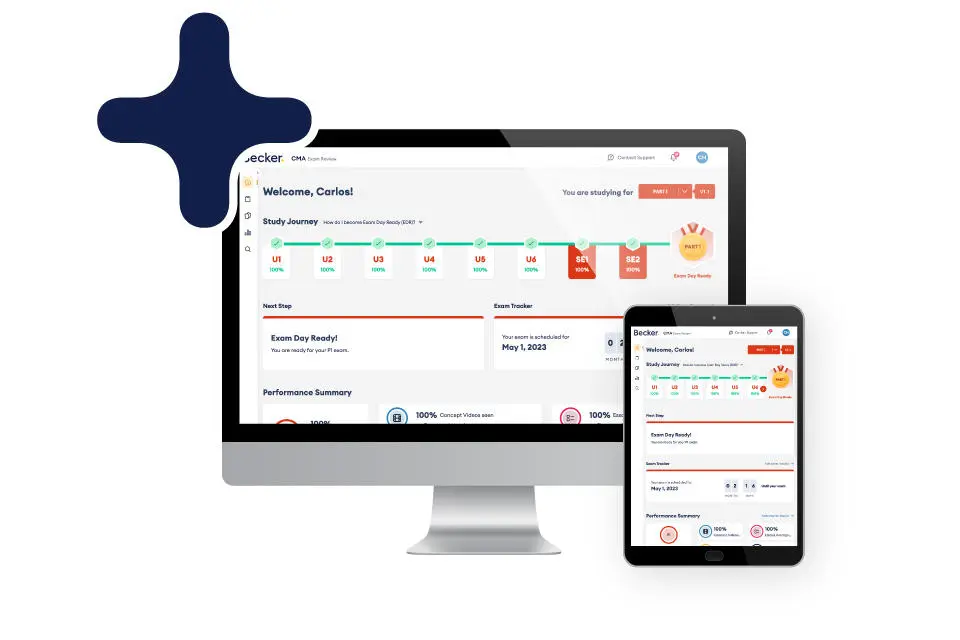

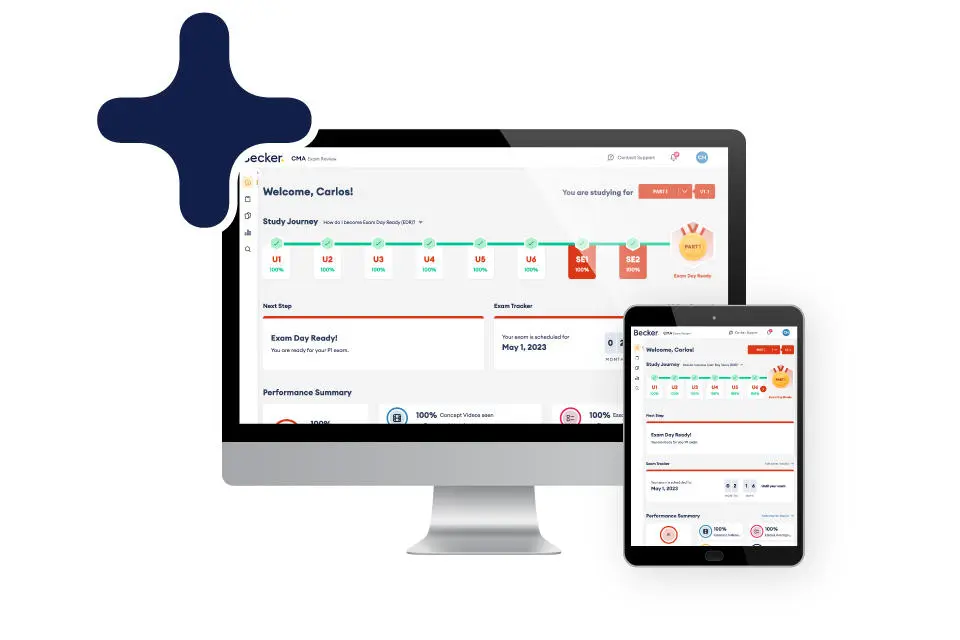

Gim.cpa’s strategic alliance with Becker Professional Education offers you a premier learning experience—designed to guide you to exam-day confidence and long-term career success.

3 Regions

Presence across Europe, South America and the Caribbean Islands

15+

20+ Years of Expertise – Supporting students in passing the CMA exam

#1

Becker’s #1 Strategic Partner – Trusted collaboration for exam preparation

1M+

1 Million+ Prepared – Accounting & finance professionals trained with Becker

96%

96% Satisfaction – Rated highly by CMA candidates using Becker’s review course

50K+

12,000+ Candidates – Finance professionals and aspiring CMAs supported

Newt

Becker's AI Exam Review Assistant helping candidates to become more effective and efficient while learning

IMA's

IMA Platinum Partner – Recognized by the Institute of Management Accountants

About the U.S. CMA

Certified Management Accountant

The Global Standard for Accounting and Finance Professionals

The U.S. CMA (Certified Management Accountant) is a globally respected credential that demonstrates mastery in management accounting and strategic decision-making. Awarded by the Institute of Management Accountants (IMA), it recognizes professionals with advanced skills in financial analysis, planning, control, and forecasting. CMAs are in high demand worldwide for their ability to drive business performance and deliver data-driven insights.

The CMA Program Covers Two Key Areas:

Part 1: Financial Planning, Performance & Analytics

Part 2: Strategic Financial Management

Results-Driven CPA Training

Expert-led instruction by certified professionals with real-world accounting and finance experience.

100% alignment with ICMA’s Learning Outcome Statements—nothing is left out.

Adaptive learning technology tailored to boost your exam readiness and retention.

A personalized and user-friendly platform that clearly monitors your learning journey.

Practice and review with question formats that mirror what you'll face on exam day.

📣 Try Becker CMA – Free for 14 Days!

Curious if the Becker CMA Review is right for you? Try it risk-free.

Your free trial includes:

- Full study materials for one unit in each exam section

- Access to digital textbooks, MCQs, essays, and flashcards

- Personalized review sessions along with unlimited practice tests

- Seamless progress tracking—continue where you left off if you enroll

Contact us and we are ready to provide you access to our 14-day trial account.

Requirements

To attain the CMA certification, you must meet the IMA’s requirements which include:

Hold an active IMA membership

Enrolling in the CMA program and registering for the CMA Exam

Possess a bachelor’s degree or equivalent professional certification

Have two years of relevant experience in management accounting or finance

Pass both Part 1 and Part 2 of the CMA exam

Adhere to the IMA’s Statement of Ethical Professional Practice

CMA Exam Essentials

The CMA exam is rigorous yet rewarding. It evaluates a wide range of competencies—including financial reporting, budgeting, forecasting, cost management, and performance measurement. Administered by the IMA, the exam is fully computer-based and divided into two parts:

Part 1

Duration: 4 hours

Format: 100 multiple-choice questions + two 30-minute essay questions

Testing Windows

January - February / May - June / September - October

Part 2

Duration: 4 hours

Format: 100 multiple-choice questions + two 30-minute essay questions

Testing Windows

January - February / May - June / September - October

CMA Student Handbook

Besides covering the eligibility criteria listed above in more detail, this guide offers a look at everything you need to know about the CMA examination and certification process. Here are just a few of the topics covered more thoroughly in the CMA Handbook:

- CMA entrance fee

- Education and experience qualifications

- Scheduling/rescheduling an appointment for an exam

- Refund policy

- Examination Administration

- The day of the exam

- Identification requirements

- Calculator policy

- Performance report

- Candidate confidentiality

- Rights and responsibilities of a CMA

- And more…

Our CMA Packages

We have the cheapest prices guaranteed because of our long partnership with Becker!

CMA REVIEW PRO PACKAGE

$2,199.00

SAVE $1100 NOW!

Start Now- Flexible Payments Options - 0% INTEREST (12 MONTHLY INSTALLMENTS OF $92)

- UNLIMITED ACCESS

- 2-part review course

- Newt, Becker's AI Exam Review Assistant

- Digital textbooks

- 500+ digital flashcards

- 4,000+ multiple choice questions

- 76 essay questions

- Lecture videos

-

Constantly updated content providing 100% coverage of the ICMA Learning Outcomes Statements

- 76 SkillBuilder videos, step-by-step expert guides to each essay question

- Adapt2U Technology driven, unlimited practice tests

- Simulated exams that replicate the CMA Exam experience

- Academic support

- Online FAQ database

- Pass Guarantee

- Printed textbooks

-

LiveOnline virtual classroom

- Online FAQ database

CMA REVIEW ADVANTAGE PACKAGE

$1,599.00

Save $200

Start Now- Flexible Payments Options - 0% INTEREST (12 MONTHLY INSTALLMENTS OF $250)

- 24 - MONTH ACCESS

- 2-part review course

- Newt, Becker's AI Exam Review Assistant

- Digital textbooks

- 500+ digital flashcards

- 4,000+ multiple choice questions

- 76 essay questions

- Lecture videos

-

Constantly updated content providing 100% coverage of the ICMA Learning Outcomes Statements

- 76 SkillBuilder videos, step-by-step expert guides to each essay question

- Adapt2U Technology driven, unlimited practice tests

- Simulated exams that replicate the CMA Exam experience

- Academic support

- Online FAQ database

Top questions answered

We know CPA Exam prep can be overwhelming.

We’re here to answer your questions.

- Full digital textbooks for both exam parts

- Thousands of multiple-choice questions and essay practice prompts

- Personalized study planner and progress tracking

- Adapt2U learning technology for a customized experience

- Unlimited practice exams and simulated test environments

- On-demand video lectures led by expert instructors

To earn the CMA designation, candidates must:

- Hold an active IMA (Institute of Management Accountants) membership

- Have a bachelor’s degree or approved professional certification

- Gain two years of professional experience in management accounting or finance

- Pass both Part 1 and Part 2 of the CMA Exam

- Comply with the IMA Statement of Ethical Professional Practice

The exam is divided into two parts:

- Part 1: Financial Planning, Performance & Analytics

- Part 2: Strategic Financial Management

Each part is 4 hours long and consists of:

- 100 multiple-choice questions

- Two 30-minute essay questions

Testing windows are available in January–February, May–June, and September–October.